Do I have to file Form 130 as a self-employed worker?

The Form 130 is the tool used by the Spanish Tax Agency (Hacienda) to collect personal income tax (IRPF) from self-employed workers whose income is not subject to withholding throughout the year. As accountants in Palma de Mallorca we explain clearly when you must file it, who is required to do so, and what exceptions exist.

This is a quarterly self-assessment for those who pay taxes under the direct estimation regime (normal or simplified). In other words, for those who, after their self-employed registration in Palma de Mallorca, determine their net income based on actual income and expenses.

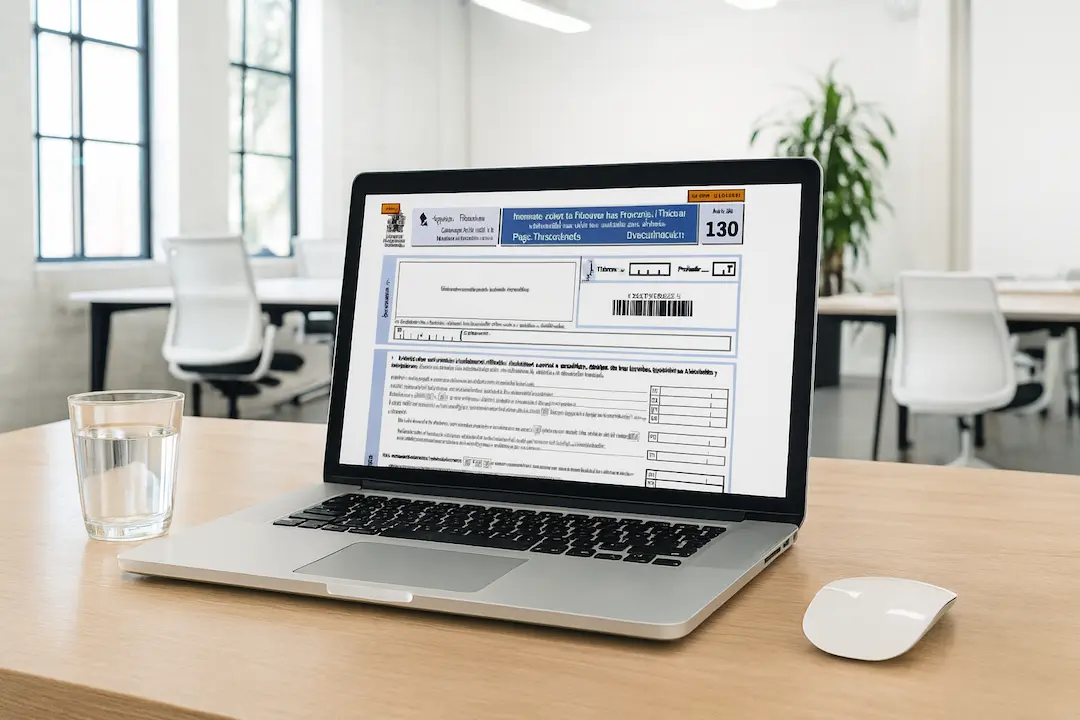

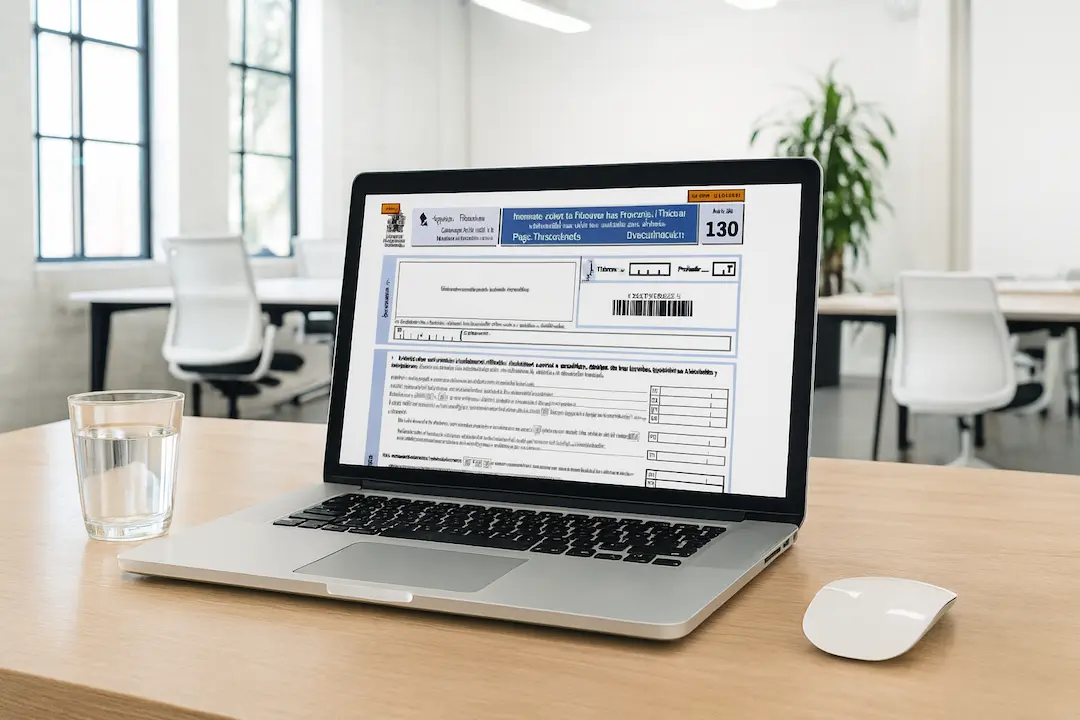

What exactly is declared in Form 130?

Form 130 is not just “checking boxes”: it summarizes the quarter’s profit and calculates the IRPF advance payment. Specifically, it includes:

- Quarterly income from the activity.

- Deductible expenses for the same period (utilities, rent, purchases, professional fees, amortizations, etc.).

- Net income (income – expenses).

- Deductions: withholdings applied on your invoices (if any) and previous advance payments made during the year.

- The final amount payable (or zero if the calculation results in no tax due).

Key idea: with Form 130 you advance part of your IRPF based on your actual quarterly profit.

Who is required to file Form 130?

- Individuals carrying out economic activities.

- Members of civil societies and partnerships whose partners are subject to IRPF.

- Taxpayers under the direct estimation regime, whether normal or simplified.

Exceptions

- Agricultural, livestock, or forestry activities: if in the previous calendar year at least 70% of income was subject to withholding or advance payment, there is no obligation to file Form 130.

- Professionals with withholdings: those who have at least 70% of their income withheld on invoices and who have not indicated in Form 036/037 the obligation to make advance payments may be exempt.

Practical examples

- Ignacio, a fruit seller with a small shop: he mainly sells directly to customers, so his income is not subject to withholding. He must file Form 130.

- Pablo, a freelance draftsman: he invoices companies and professionals with withholding and exceeds the 70% threshold retained. He will probably not have to file Form 130.

Private clients vs. business clients

The type of client determines the obligation:

- If you work mostly with individuals (e.g., tutors, trainers, private investigators), your invoices do not carry withholding → you must file Form 130.

- If you provide services to companies or professionals (consulting, advisory, law), your invoices do include withholding, and you may be exempt if more than 70% of your income is withheld.

Remember: for companies and other self-employed professionals you must apply IRPF withholding (generally 15%, or 7% for new freelancers). For individuals, there is no withholding; only VAT is applied when required.

When is the deadline to file Form 130?

Form 130 is a quarterly return for IRPF advance payments. Each partner in civil societies or partnerships must file it proportionally to their share in the profits. The usual deadlines are:

- Q1: April 1–20

- Q2: July 1–20

- Q3: October 1–20

- Q4: January 1–30

(If the last day falls on a non-business day, the deadline is extended to the next working day according to the AEAT calendar).

What about self-employed under the modules regime?

Those taxed under objective estimation (modules) do not use Form 130; instead, they must file Form 131. Under modules, tax is calculated using objective parameters (such as business premises size, electricity consumption, number of employees, etc.), not actual income and expenses.

- Direct estimation (normal or simplified): Form 130.

- Objective estimation (modules): Form 131.

Summary

Form 130 is used to pay quarterly IRPF advances for self-employed workers under direct estimation whose income is not sufficiently withheld. There are exceptions when 70% or more of income is already subject to withholding, particularly for professionals or agricultural activities. If you are taxed under modules, the correct form is Form 131.

Do I have to file Form 130 as a self-employed worker?

The Form 130 is the tool used by the Spanish Tax Agency (Hacienda) to collect personal income tax (IRPF) from self-employed workers whose income is not subject to withholding throughout the year. As accountants in Palma de Mallorca we explain clearly when you must file it, who is required to do so, and what exceptions exist.

This is a quarterly self-assessment for those who pay taxes under the direct estimation regime (normal or simplified). In other words, for those who, after their self-employed registration in Palma de Mallorca, determine their net income based on actual income and expenses.

What exactly is declared in Form 130?

Form 130 is not just “checking boxes”: it summarizes the quarter’s profit and calculates the IRPF advance payment. Specifically, it includes:

- Quarterly income from the activity.

- Deductible expenses for the same period (utilities, rent, purchases, professional fees, amortizations, etc.).

- Net income (income – expenses).

- Deductions: withholdings applied on your invoices (if any) and previous advance payments made during the year.

- The final amount payable (or zero if the calculation results in no tax due).

Key idea: with Form 130 you advance part of your IRPF based on your actual quarterly profit.

Who is required to file Form 130?

- Individuals carrying out economic activities.

- Members of civil societies and partnerships whose partners are subject to IRPF.

- Taxpayers under the direct estimation regime, whether normal or simplified.

Exceptions

- Agricultural, livestock, or forestry activities: if in the previous calendar year at least 70% of income was subject to withholding or advance payment, there is no obligation to file Form 130.

- Professionals with withholdings: those who have at least 70% of their income withheld on invoices and who have not indicated in Form 036/037 the obligation to make advance payments may be exempt.

Practical examples

- Ignacio, a fruit seller with a small shop: he mainly sells directly to customers, so his income is not subject to withholding. He must file Form 130.

- Pablo, a freelance draftsman: he invoices companies and professionals with withholding and exceeds the 70% threshold retained. He will probably not have to file Form 130.

Private clients vs. business clients

The type of client determines the obligation:

- If you work mostly with individuals (e.g., tutors, trainers, private investigators), your invoices do not carry withholding → you must file Form 130.

- If you provide services to companies or professionals (consulting, advisory, law), your invoices do include withholding, and you may be exempt if more than 70% of your income is withheld.

Remember: for companies and other self-employed professionals you must apply IRPF withholding (generally 15%, or 7% for new freelancers). For individuals, there is no withholding; only VAT is applied when required.

When is the deadline to file Form 130?

Form 130 is a quarterly return for IRPF advance payments. Each partner in civil societies or partnerships must file it proportionally to their share in the profits. The usual deadlines are:

- Q1: April 1–20

- Q2: July 1–20

- Q3: October 1–20

- Q4: January 1–30

(If the last day falls on a non-business day, the deadline is extended to the next working day according to the AEAT calendar).

What about self-employed under the modules regime?

Those taxed under objective estimation (modules) do not use Form 130; instead, they must file Form 131. Under modules, tax is calculated using objective parameters (such as business premises size, electricity consumption, number of employees, etc.), not actual income and expenses.

- Direct estimation (normal or simplified): Form 130.

- Objective estimation (modules): Form 131.

Summary

Form 130 is used to pay quarterly IRPF advances for self-employed workers under direct estimation whose income is not sufficiently withheld. There are exceptions when 70% or more of income is already subject to withholding, particularly for professionals or agricultural activities. If you are taxed under modules, the correct form is Form 131.

Seguir leyendo

Gestoría en Palma de Mallorca.

Si buscas una gestoría cerca de ti, asesoramos a empresas en el ámbito laboral, fiscal y contable. También somos una gestoría administrativa en Palma y realizamos traspasos de vehículos.